Highlights of my favorite player, Bobby Sura, over his career.Robert Sura Jr. (born March 25, 1973, in Wilkes-Barre, Pennsylvania) is an American former prof. Robert sura poker club. Robert Sura has won 0 bracelets and 0 rings for total earnings of $0. See all events where they placed in-the-money. MOST TRUSTED BRAND IN POKER. Born Robert Sura Jr. On the 25th March 1973 in Wilkes-Barre, Pennsylvania USA, Bob is a former professional basketball player, who played a shooting guard in the National Basketball League (NBA) for the Cleveland Cavaliers, Golden State Warriors, Detroit Pistons, Atlanta Hawks and Houston Rockets. Sura's career started in 1995 and ended in 2005. (born March 25, 1973) is an American former professional basketball player who played ten seasons for five different teams in the National Basketball Association (NBA). At 6 ft 5 in (1.96 m), 200 pounds (91 kg), he played as a shooting guard.

Montgomery Park Business Center, Suite 330 1800 Washington Blvd., Baltimore, MD 21230 (410) 230-8800; fax: (410) 230-8728 1-800-522-4700 (problem gambling helpline). 8% state tax for non-Maryland residents For prizes of $500 to $5,000, you must file a Maryland Payment Voucher Form and pay taxes on those winnings within 60 days of receiving your prize. Instructions and additional information are available from the Comptroller of Maryland's website.

BALTIMORE - Gov. Martin O'Malley looked into the camera in 2012 and told his audience that expanded casino gambling would mean 'hundreds of millions of dollars for our schools.'

The upcoming referendum on gambling had propelled Maryland's schools into the spotlight of a multimillion-dollar campaign where supporters touted the message that more gambling would be a win for education.

But the measure, approved by voters that fall, has actually worked to send more money to the casino companies this fiscal year than to the education fund that was established when the state first legalized casino gambling in 2008.

The 2008 law set up an Education Trust Fund to receive the lion's share of gambling revenues from slots at five new casinos: About half of the slots revenue went directly to the education fund and an additional 18.5 percent to other state programs. The casino companies generally kept no more than 33 percent.

But the 2012 law included concessions for the companies to ease their concerns over the addition of a mega-casino in Prince George's County. The legislation allowed all casinos to add lucrative table games, such as poker, craps and roulette. And it allowed the companies to keep 80 percent of the table game proceeds -- while also reducing the share of slots money that goes to the education fund.

As a result, casino companies have kept more than $334 million of the revenues so far this fiscal year while the Education Trust Fund has gotten close to $270 million -- marking the first time since casinos opened in Maryland that more of the gambling proceeds will go to the casino companies than to the education fund.

And while expansion of gambling has raised more money overall both for casinos and the education fund, the money in the Education Trust Fund has replaced -- not added to -- general fund revenues normally spent on schools.

O'Malley, Senate President Thomas V. 'Mike' Miller Jr. and House Speaker Michael E. Busch all declined to comment on the Capital News Service findings, according to their spokespersons.

The casino revenue is 'helpful, but it's not helpful in the way that some politicians have claimed it's helpful,' said Charlie Cooper, secretary of the Maryland Education Coalition.

'If we get $300 million in casino revenues, it doesn't increase school funding by $300 million, and in fact, it may not increase school funding at all.'

'A fiscal fairy tale'

Comptroller Peter Franchot made a prediction in 2008, with the question of legalizing casino gambling before Maryland voters:

'Slots are a fiscal fairy tale,' he said. The plan 'will not produce one dollar of new spending for education, and I encourage everybody to understand that this industry is a shady and sleazy practice.'

The plan to legalize slots had come from an unlikely source. O'Malley had spoken out against gambling proposals as mayor of Baltimore. But when he became governor in 2007, Maryland faced a $1.7 billion structural deficit in the midst of an increasingly dismal economy.

He called for a special session that fall to address the state's budget woes, announcing plans to generate revenue through tax reform and the authorization of slot machines in five casino locations around the state.

But he had to win over lawmakers who blocked attempts to legalize casino gambling under former Gov. Robert L. Ehrlich Jr. So O'Malley recommended that the legislature approve a plan for legalization and then put it up for a vote at referendum. He also increased the number of slot machines in his proposal to 15,000 from 9,500, appeasing slots supporters not thrilled about the added step of a referendum.

After contentious debate, the deal that emerged from Annapolis was one that taxed casinos at among the highest rates of any state in the nation. Maryland would keep about 67 percent of the revenue from slots, with most -- roughly half of all casino revenue -- going to an Education Trust Fund dedicated to schools.

The Maryland Chamber of Commerce and AFSCME, the American Federation of State, County and Municipal Employees, threw their support behind the slots measure -- as did the gambling industry. Pro-slots groups outspent opponents 7-to-1, with the Laurel Racing Association and Penn National Gaming contributing a combined $5 million to the total $7.1 million spent on supporting slots.

The Maryland teachers union voted to endorse the measure too, after Miller, the Senate president and a leading slots advocate, warned the union that education spending could face significant cuts if the slots measure failed and the state's budget trouble continued.

On Nov. 4, 2008, Maryland residents approved the slots measure with nearly 59 percent of the vote.

A package of tax breaks

Before even one of the original five casinos had opened, Maryland lawmakers began weighing the question of expanding casino gambling.

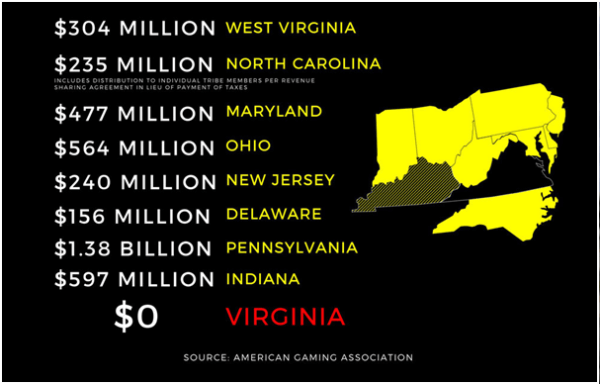

Miller, a Democrat from Prince George's County, announced an interest in early 2010 in adding a sixth casino there. Not long after, the state panel charged with awarding the casino licenses recommended that lawmakers consider allowing table games to help Maryland compete with gambling in surrounding states. Pennsylvania, Delaware and West Virginia had all moved to allow table games after Maryland passed its slots-only measure in 2008.

In June 2012, MGM Resorts International announced its interest in building a casino at the National Harbor in Prince George's County, if presented with an acceptable deal -- which included a lower tax rate and table games.

O'Malley called a special session the following month to debate a gambling expansion that would include a sixth casino and Las Vegas-style table games.

But lawmakers met with fierce resistance from some of the companies holding Maryland casino licences, especially the Cordish Cos., owner of Maryland Live! Casino in Anne Arundel County.

Company representatives complained that the proposed sixth casino would be an unexpected, and unwelcome, source of competition that would diminish its customer base and hurt its bottom line.

So, the legislature offered tax breaks to the companies.

Casino companies would get to keep 80 percent of table game revenue and give 20 percent to the Education Trust Fund. The education fund's share would drop to 15 percent in 2017, when the local governments that host casinos would begin receiving 5 percent of table game revenue.

Maryland State Gambling Tax Refund

The education fund's share of slots revenue would shrink too.

Maryland State Gambling Tax Forms

The General Assembly passed the measure, sending it to a referendum as required by the 2008 slots law.

MGM, with its eye on the sixth casino license, gave close to $41 million to the rival, pro-expansion group, For Maryland Jobs and Schools.

Penn National Gaming, with casinos in West Virginia, Pennsylvania and Perryville, Md., led the opposition, spending more than $44 million, according to the National Institute on Money in State Politics.

The teachers union took no position.

After the most expensive campaign in state history -- totalling more than $94.9 million -- the referendum passed with 51.9 percent of the vote.

An 'outrageous' break

Sen. James Brochin, D-Baltimore County, in a recent interview said he supported legalization in 2008 but voted against the expansion bill because he thought the state was giving far too much away to the casinos as part of the compromise.

'The tax break that we gave the casino operators was outrageous,' he said.

Maryland Lottery and Gaming Control Agency officials say that granting casino companies a bigger share of the revenue from table games makes sense because those games cost more to operate than slot machines, with additional expenses including pay for dealers. The casinos also received breaks for taking over ownership of the slot machines from the state.

Additionally, a lower tax rate allows casinos to invest more in marketing and promotional programs that bring in more customers and more money, said Will Cummings, of Cummings Associates, which did a study for the state gambling agency.

In fact, casino revenues have soared since table games debuted in Maryland last spring, sending more total dollars to the state as a result.

After contentious debate, the deal that emerged from Annapolis was one that taxed casinos at among the highest rates of any state in the nation. Maryland would keep about 67 percent of the revenue from slots, with most -- roughly half of all casino revenue -- going to an Education Trust Fund dedicated to schools.

The Maryland Chamber of Commerce and AFSCME, the American Federation of State, County and Municipal Employees, threw their support behind the slots measure -- as did the gambling industry. Pro-slots groups outspent opponents 7-to-1, with the Laurel Racing Association and Penn National Gaming contributing a combined $5 million to the total $7.1 million spent on supporting slots.

The Maryland teachers union voted to endorse the measure too, after Miller, the Senate president and a leading slots advocate, warned the union that education spending could face significant cuts if the slots measure failed and the state's budget trouble continued.

On Nov. 4, 2008, Maryland residents approved the slots measure with nearly 59 percent of the vote.

A package of tax breaks

Before even one of the original five casinos had opened, Maryland lawmakers began weighing the question of expanding casino gambling.

Miller, a Democrat from Prince George's County, announced an interest in early 2010 in adding a sixth casino there. Not long after, the state panel charged with awarding the casino licenses recommended that lawmakers consider allowing table games to help Maryland compete with gambling in surrounding states. Pennsylvania, Delaware and West Virginia had all moved to allow table games after Maryland passed its slots-only measure in 2008.

In June 2012, MGM Resorts International announced its interest in building a casino at the National Harbor in Prince George's County, if presented with an acceptable deal -- which included a lower tax rate and table games.

O'Malley called a special session the following month to debate a gambling expansion that would include a sixth casino and Las Vegas-style table games.

But lawmakers met with fierce resistance from some of the companies holding Maryland casino licences, especially the Cordish Cos., owner of Maryland Live! Casino in Anne Arundel County.

Company representatives complained that the proposed sixth casino would be an unexpected, and unwelcome, source of competition that would diminish its customer base and hurt its bottom line.

So, the legislature offered tax breaks to the companies.

Casino companies would get to keep 80 percent of table game revenue and give 20 percent to the Education Trust Fund. The education fund's share would drop to 15 percent in 2017, when the local governments that host casinos would begin receiving 5 percent of table game revenue.

Maryland State Gambling Tax Refund

The education fund's share of slots revenue would shrink too.

Maryland State Gambling Tax Forms

The General Assembly passed the measure, sending it to a referendum as required by the 2008 slots law.

MGM, with its eye on the sixth casino license, gave close to $41 million to the rival, pro-expansion group, For Maryland Jobs and Schools.

Penn National Gaming, with casinos in West Virginia, Pennsylvania and Perryville, Md., led the opposition, spending more than $44 million, according to the National Institute on Money in State Politics.

The teachers union took no position.

After the most expensive campaign in state history -- totalling more than $94.9 million -- the referendum passed with 51.9 percent of the vote.

An 'outrageous' break

Sen. James Brochin, D-Baltimore County, in a recent interview said he supported legalization in 2008 but voted against the expansion bill because he thought the state was giving far too much away to the casinos as part of the compromise.

'The tax break that we gave the casino operators was outrageous,' he said.

Maryland Lottery and Gaming Control Agency officials say that granting casino companies a bigger share of the revenue from table games makes sense because those games cost more to operate than slot machines, with additional expenses including pay for dealers. The casinos also received breaks for taking over ownership of the slot machines from the state.

Additionally, a lower tax rate allows casinos to invest more in marketing and promotional programs that bring in more customers and more money, said Will Cummings, of Cummings Associates, which did a study for the state gambling agency.

In fact, casino revenues have soared since table games debuted in Maryland last spring, sending more total dollars to the state as a result.

Even so, Brochin argues, the state is taking in millions of dollars less than it should be.

As a result, the casino industry has pushed ahead of the education fund as the biggest beneficiary of state-sponsored gambling in Maryland.

The amount of revenue going to casino operators each month of fiscal year 2014 has surpassed the amount going to the Education Trust Fund. For the first time since Maryland legalized casinos, the casino companies are on track to take in more money this fiscal year than the Education Trust Fund.

'It was just bad public policy,' Brochin said.

Replacing, not supplementing, funds for schools

For Maryland schools, the argument over how much should go to casinos versus the education fund has been strictly academic so far.

Neither the 2008 nor 2012 legislation specified that the state should spend more on education with the gambling revenue. And the legislature hasn't.

Since the first casino opened in Maryland, almost $700 million gambling dollars have gone into the Education Trust Fund. But lawmakers have used that money to replace rather than increase general fund revenues normally spent on schools. In other words, they have used it to free up general fund money for other purposes.

While the state's education budget has fluctuated, that has been due largely to other factors like federal contributions.

There's another reason the casino money has had little obvious impact on schools: Last year's education budget totaled more than $7 billion, with the $285 million in the Education Trust Fund accounting for just a small fraction.

Still, education advocates have a list of things the extra money could be used for, from expanding access to high-quality pre-K to improving mental health services at schools.

'I certainly understand the position the state was in for several years, but I think now is the time to really go back to this and take a look,' said David Beard, the education policy director at Advocates for Children and Youth in Baltimore. 'Are we just supplementing dollars and supplanting or are we really using this for opportunities to improve education and educational outcome?'

Many people who live in Maryland work in other states, and many people who live in other states maintain employment here in Maryland. This is true of full-time, part-time, and self-employed individuals, and it's especially common for residents of the greater Baltimore area. Living and working in two different areas can make things a bit tricky during tax season, so we want to clear up any confusion and make things as simple as possible for you when it comes time to file your returns this spring.

Keep reading to learn more about nonresident returns, including when you're required to file a nonresident return and even some instances where people who live and work in different states are not required to file a nonresident return. And, as always, if you have any questions about your filing status or other issues, please reach out to our team at S.H. Block Tax Services for help.

Who Needs to File a Nonresident Tax Return?

Individuals who have earned money in a state other than the one in which they permanently reside generally must file a nonresident state tax return. For instance, if you live in Maryland but work in Wilmington, you'll need to file a nonresident return in Delaware.

Additionally, you might have to file a nonresident return if your employer mistakenly withheld taxes for the wrong state and you want to receive your refund from that state. You will likely also have to file a nonresident return if you received non-employment income in a state other than the one in which you reside.

Non-Employment Income Taxes for Nonresidents

Taxpayers who earn or receive income from out of state must file nonresident returns in addition to tax returns in their home state. Don't worry, though — you won't be forced to pay income taxes more than once. Sometimes, even if you don't perform your job functions in another state, you might have to file income in one since most states tax all income sourced to their state.

Here are a few examples where you would likely need to file a nonresident income tax return: Colette doherty poker videos.

- Business partnerships: If you earn income as a partner in an LLC, S-corporation, or another type of verified business partnership based in a state other than the one in which you reside, that income is likely taxable in the state(s) in which the partnership exists.

- Out-of-state services: Individuals who frequently travel to a neighboring state to perform services (e.g., a plumber crossing state lines to fix piping issues) must complete a nonresident return.

- Gambling profits: Taxpayers who make more than $5,000 from out-of-state gambling winnings or by playing another state's lottery are subject to nonresident income taxes.

- Property income: If you've sold a piece of property or you collect rent for a property in a state other than the one in which you reside, you'll have to complete a nonresident income tax return.

What Is a Reciprocal State?

Reciprocal states have agreements with neighboring states that allow individuals to work there without having to file a nonresident return. Many states have created these arrangements because they have major urban areas close to their borders. For example, employees who live in Bethesda but work in Washington D.C. are usually not required to file a nonresident income tax return (although they might still have to file a nonresident return if they have non-employment income from D.C. or if they had taxes withheld there). There are a few other exceptions to reciprocal state agreements, so please contact an experienced tax resolution representative if you want to know more.

As of 2018, 15 states have reciprocal agreements with one or more of their neighbors. These states include:

- Arizona

- Illinois

- Indiana

- Iowa

- Kentucky

- Maryland

- Michigan

- Minnesota

- Montana

- North Dakota

- Ohio

- Pennsylvania (ended agreement with New Jersey in 2016)

- Virginia

- West Virginia

- Wisconsin

- District of Columbia (agreements with Maryland and Virginia)

Contact S.H. Block Tax Services to Learn More

As a firm operating in Baltimore, where interstate work commutes are common, we have extensive experience dealing with nonresident tax returns and other complex tax filing issues. We've also handled a wide range of other tax liability issues for our clients, and we've helped thousands resolve their tax debt, re-enter compliance with the IRS and the State of Maryland, and forge a path back to financial freedom.

If you would like to schedule a free consultation to discuss your personal or business tax issues or ask any filing questions, please contact S.H. Block Tax Services today by calling (410) 793-1231 or completing this brief form. Our firm has achieved an A+ rating with the Better Business Bureau, and our attorneys and helpful support staff are ready to get to work on your behalf.